The revolution of Artificial Intelligence is underway. After decades of hesitation since its birth in 1956*, it experienced a phenomenal acceleration with the thunderous arrival of ChatGPT and generative AI in 2022. Since then, it has been evolving at an exponential pace, gaining power and relevance, and impacting all sectors of activity, even the most unlikely ones.

Artificial Intelligence is not just another change, it is a paradigm shift that transforms the way we analyze and decide, interact, and even create. It is not uncommon to observe efficiency gains not of 20 or 30%, as is usually the case with improvements to existing processes, but of several thousand percent – highlighting the fundamentally new nature of this technology.

Thus, an Excel file containing a vast amount of data can be analyzed and summarized according to the desired perspectives in just a few seconds – a task that would have taken a human several hours to complete, and likely in a less comprehensive way.

From this very simple example, we can draw several fundamental and inseparable principles of AI:

-

- Interconnection with data, which is essential without it, AI can do nothing.

-

- The real-time or near real-time dimension.

- Flexibility and agility.

If AI is merely an additional layer applied to a heavy, often aging system, it cannot fully express its potential given the technical environment in which it is-willingly or unwillingly-installed.

Artificial Intelligence in Credit Management

Credit management is a discipline of systemic and relational interactions, based on a large quantity and wide variety of data:

-

- External interactions with the company’s clients and third-party services (financial information providers, credit insurers, etc.), as well as internal interactions between different departments (management, sales, customer service, etc.).

- Commercial and accounting data, financial and sectoral data, and behavioral and informal data (information coming from the market or sales teams, etc.).

The capabilities of Artificial Intelligence are therefore perfectly suited to the world of credit management. It assists in analyzing customer-related data and account status, provides recommendations for optimal customer risk management and debt collection, and proposes and/or carries out appropriate actions, determined through the consideration of multiple pieces of information, both current and historical, internal and external.

It brings comfort and efficiency to credit managers and collection officers, provided that the software in which it is integrated applies its fundamental principles: interconnection, real time, and flexibility.

The limits of AI in Credit Management

Like any tool, however relevant it may be, Artificial Intelligence has its limits in credit management. These can be grouped into three main categories:

-

- The inability of AI to access comprehensive data AI does not have access to all types of data – particularly informal information relating to the commercial relationship, its stakes and specific characteristics, or the human dimension inherent in that relationship. As a result, being not fully informed, its analyses and recommendations may sometimes lack relevance or suitability.

-

- The probabilistic nature of AI because AI operates based on probabilities, it can experience “hallucinations” generating results that are inaccurate or incorrect. Its degree of precision is therefore not 100%.

-

- The absence of human qualities even though AI increasingly mimics human-like behavior, it remains incapable of embodying qualities that are intrinsically tied to human nature – qualities that are essential in credit management and debt collection: consideration, recognition, compassion, discernment, gratitude, and so on.

This disqualifies it, for example, from conducting phone calls with supplier accounting departments where its use would immediately signal a lack of consideration from the supplier toward the client or from leading high-stakes discussions concerning the buyer’s financial situation and the adaptation of payment terms.

Artificial Intelligence in CollectSmart

The CollectSmart SaaS software for credit management and debt collection is particularly well-suited to Artificial Intelligence, as it is fully aligned with its fundamental principles.

Flexible and agile by nature whether in its implementation, its scalable configuration, or its business features. It also operates 100% in real time, transcending the traditional heaviness of management software and providing users with unparalleled comfort and ergonomics.

As a bidirectionally interconnected software with multiple third-party solutions, CollectSmart streamlines system-to-system communication and enhances relationships between people.

The advantages of Artificial Intelligence can thus be fully expressed within CollectSmart:

-

- The ease of interaction with other systems makes it possible to integrate data of multiple types, which enriches the AI and makes it more relevant.

-

- Its flexibility allows the user to benefit from the advantages of AI while maintaining control to adapt or even correct when necessary. In doing so, the user contributes to improving the model, which in turn learns from the user.

- As a 100% real-time software, CollectSmart can therefore fully harness this natural dimension of AI, delivering greater relevance and responsiveness.

AI in CollectSmart takes several forms, depending on the specific area of application:

-

- Smart Upload AI automatically integrates our clients’ commercial and accounting data, regardless of their format or origin. Compatible with all systems used worldwide, it ensures a fast and seamless implementation across five continents. Its flexibility allows CollectSmart to be faithfully adapted to each client’s organization, enabling faster, higher-quality, and more scalable deployment.

-

- Search & Assign AI intelligently applies, in near real time, your credit management and debt collection settings and strategies. Search & Assign is an algorithmic AI that manages collection officers’ portfolios, follow-up scenarios, certain customer segmentations, DCL and unnamed guarantees, as well as other client-level configurations – all contributing to greater relevance and effectiveness in the actions carried out.

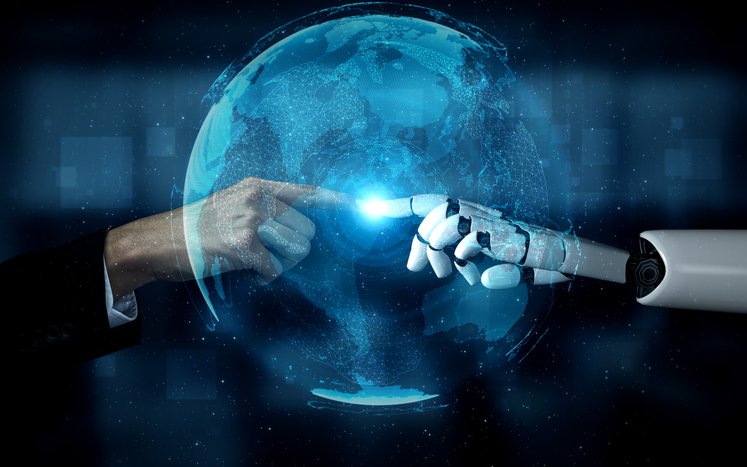

MAIA is CollectSmart generative AI, increasingly involved in users’ day-to-day activities.

MAIA is CollectSmart generative AI, increasingly involved in users’ day-to-day activities.-

MAIA Chatbot, it provides instant support on CollectSmart features and on best practices in credit management.

MAIA Chatbot, it provides instant support on CollectSmart features and on best practices in credit management.

-

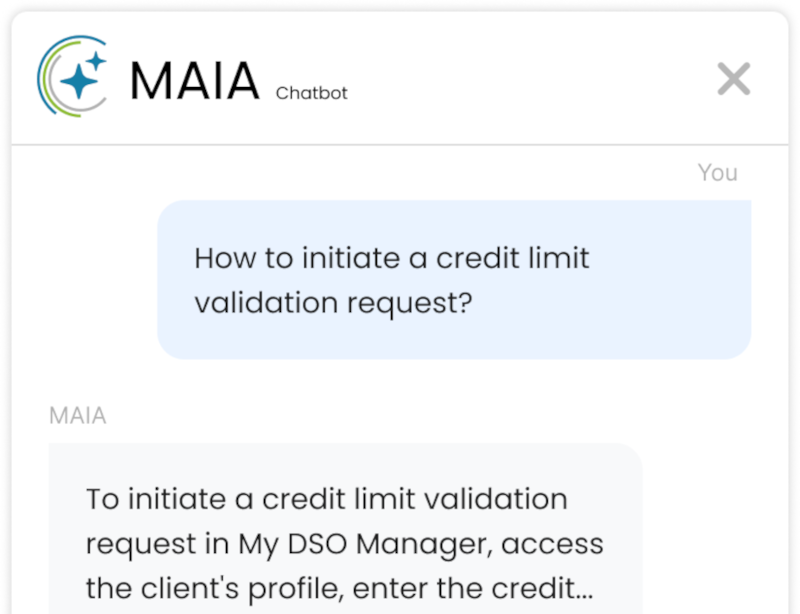

MAIA Feedbacks and

MAIA Feedbacks and  MAIA Emails, interpret and qualify client responses obtained through the interactive page, connectors with platforms (such as Chorus PRO, approved platforms, etc.), and email replies integrated within CollectSmart, even suggesting the most appropriate next action to take.

MAIA Emails, interpret and qualify client responses obtained through the interactive page, connectors with platforms (such as Chorus PRO, approved platforms, etc.), and email replies integrated within CollectSmart, even suggesting the most appropriate next action to take.

MAIA Feedbacks

MAIA Feedbacks

MAIA Emails

MAIA Emails

MAIA Actions (currently in development) will prioritize, within the collection and risk agendas, the most important actions to be carried out.

MAIA Actions (currently in development) will prioritize, within the collection and risk agendas, the most important actions to be carried out.

MAIA Reports (coming soon) will offer personalized reports, summaries, and analyses for each client or any other data scope within CollectSmart.

MAIA Reports (coming soon) will offer personalized reports, summaries, and analyses for each client or any other data scope within CollectSmart.

Artificial Intelligence in credit management is inseparable from interconnectivity between systems, agility, and real-time operation.It is only the combination of these three elements that makes Artificial Intelligence truly useful, relevant, and open to future developments.

Ultimately, AI is an integral part of the ongoing digital revolution in customer relations. It feeds on other aspects of digitalization and must be integrated into systems that are themselves agile in order to truly reveal its constantly evolving potential.

CollectSmart vision is to integrate and enhance AI in the service of the user to make them more efficient and more insightful, while allowing them to highlight their qualities and skills in precisely those areas where AI is less useful.

Artificial Intelligence is an enhancer of human capability. The mistake would be to believe that it replaces it. In reality, it exponentially increases human added value and while it enables greater productivity, it also makes humans even more essential in what remains: the human relationships that are inseparable from business relationships.

-