Powerful credit management tools that redefine your efficiency

At Asimal, we believe efficiency starts with smart credit control. Through our CollectSmart platform, we empower businesses to streamline receivables, minimise risk, and convert outstanding invoices into predictable cash flow. Because when your credit & collection functions run smoothly, you’re free to focus on growth.

Future Tech Growth

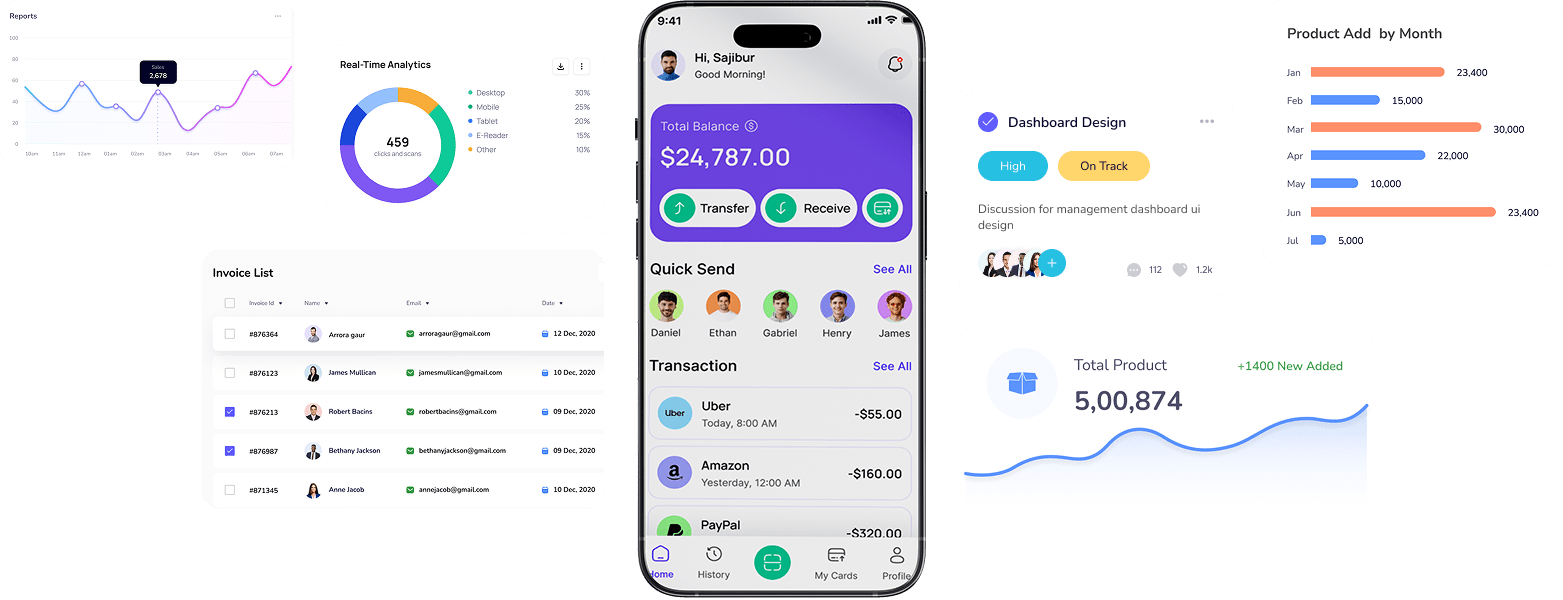

Transform workflows using our innovative features.

Transform workflows with our innovative features, improving efficiency, streamlining processes, enhancing collaboration, and driving consistent growth.

Process We Follow

Streamline processes using innovative features

CollectSmart is a SaaS (Software as a Service) Credit Management and Cash Collection Software published by P2B Solutions, a company entirely dedicated to the development of the solution.

CollectSmart was born from the observation that companies are financially penalized by late payments because they do not have an efficient Credit Management solution to reduce them.

Our objective is to provide Large International Groups, mid-sized companies, or SMEs, with an agile credit management and cash collection software that is quick to set up, thanks to its flexibility. Functionalities are intuitive and innovative, which enables them to improve their cash flow, ensure their sustainability, and development.

Natively international software, CollectSmart is used by thousands of companies of all sizes worldwide.

Our approach is to use the power of modern technologies: interconnectivity between systems, real-time, artificial intelligence, etc., to combine automation and personalization. Indeed, we believe that effective credit risk management and cash collection accelerate collections while strengthening the customer relationship through personalized and qualitative contacts and effective dispute resolution.

CollectSmart is therefore a cash collection software allowing to streamline and personalize exchanges with its customers to achieve the objectives of its company, which are at the same time:

- improve cash flow and Working Capital Requirement (WCR)

- ensure revenue growth while avoiding non-payment

- increase customer satisfaction